In Which Industries Is Hedging Used Most Often

These companies do still have to report their financials and can do so more simply when they use hedge accounting. Other farmers and dealers hedge coffee cocoa.

Commodity Hedging Basic Facts You Should Know Enhelix Commodity Trading Crude Oil Basic Facts

In simple words hedging in the stock market is used as a risk management strategy.

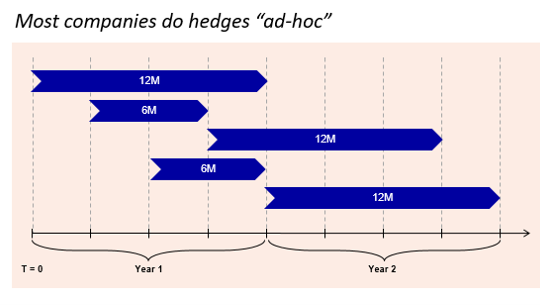

. How is hedging used today. 1 If you go on to the national lottery website it will tell you the most frequently drawn numbers. However this is a purely ad hoc procedure to find a better and more elaborate model consistent with the market smile.

Depending on what youre writing sometimes you have no choice but to use hedging words to hedge for example in academic writing legal documents and news reports. Then filtering that list for the companies at a point in their growth cycle. Do you want to know more about hedging.

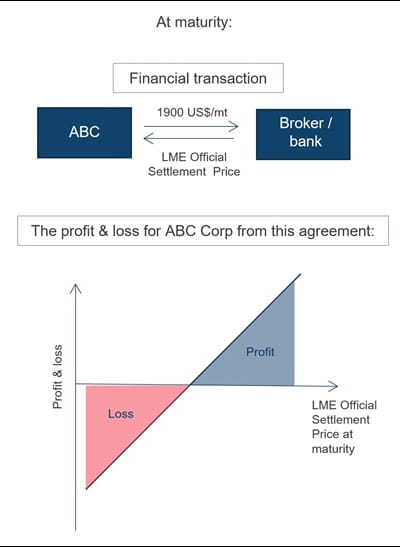

Unlike forward contractsoptions give the buyer the right not the. It helps reduce the risks associated with trading stocks in a volatile market. Hedge accounting is not a compulsory system but is often used in industries and companies that have a lot of volatility in the value of an asset or liability.

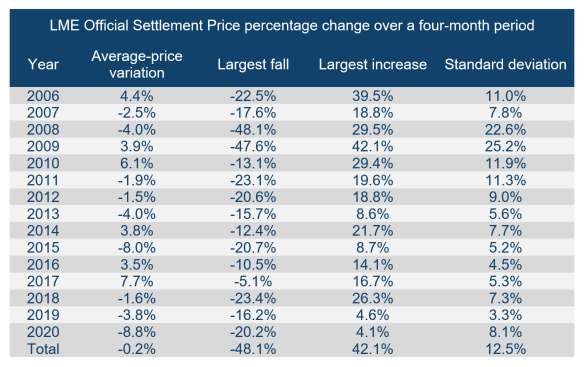

Hedging is used to safeguard ones investments in the stock market against unexpected price movement. Volatile industries such as telecommunications inevitably occur. To help you evaluate a companys use of derivatives for hedging risk well look at the three most common ways to use derivatives for hedging.

A study with a wider scope was conducted by Ben-David who researched the effectiveness of the foreign currency hedging abilities afforded by the futures market. However a main obstacle. To conform to academic standards of speech and writing.

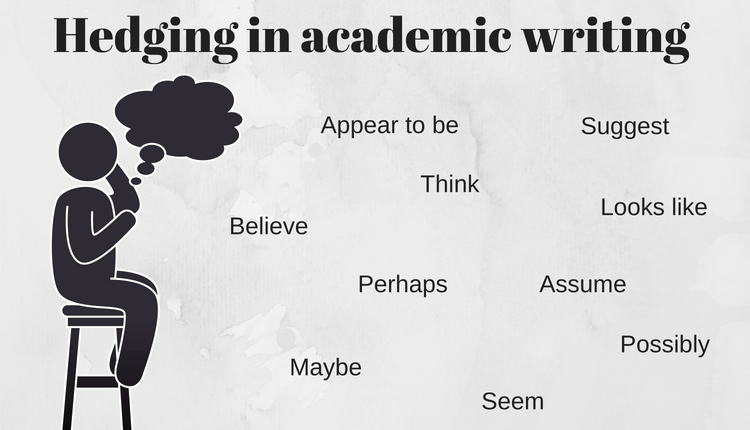

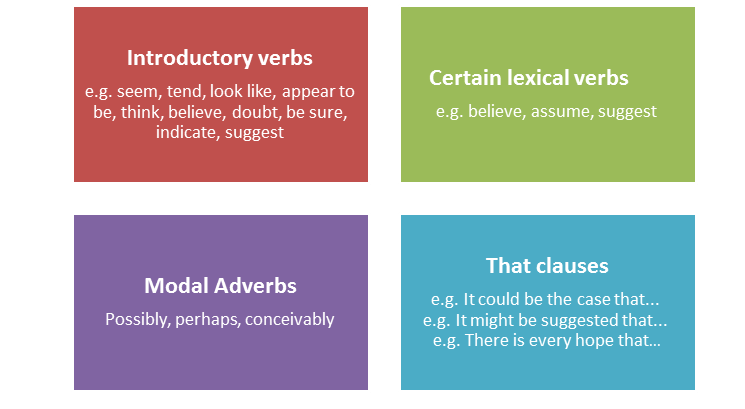

Hedging is an important component and characteristic of academic writing. The filings showed on average airlines hedged about 20 percent of the following years fuel expenses. A stock trader believes that the stock price of Company A will rise over the next month due to the companys new and efficient method of producing widgets.

Associated risk is offset by purchasing or short selling securities to secure assets from price instability or. This strategy is as simple as it sounds. The higher a companys net worth the more it hedged Rampini said.

In general using hedging words and phrases should be a conscious choice with a purpose and not a habitual feature of your writing that runs the risk of you sounding like you dont have. Hedging is used by large companies investment funds but also certainly by private investors. Often used interest-rate contract and fo rwards and futures the most often-used currency contract.

In academic writing it is prudent to be cautious in ones statements so as to distinguish between facts and claims. Then if the price rises to point between their two buy prices the profits from the second buy may offset losses in the first. What does it look like.

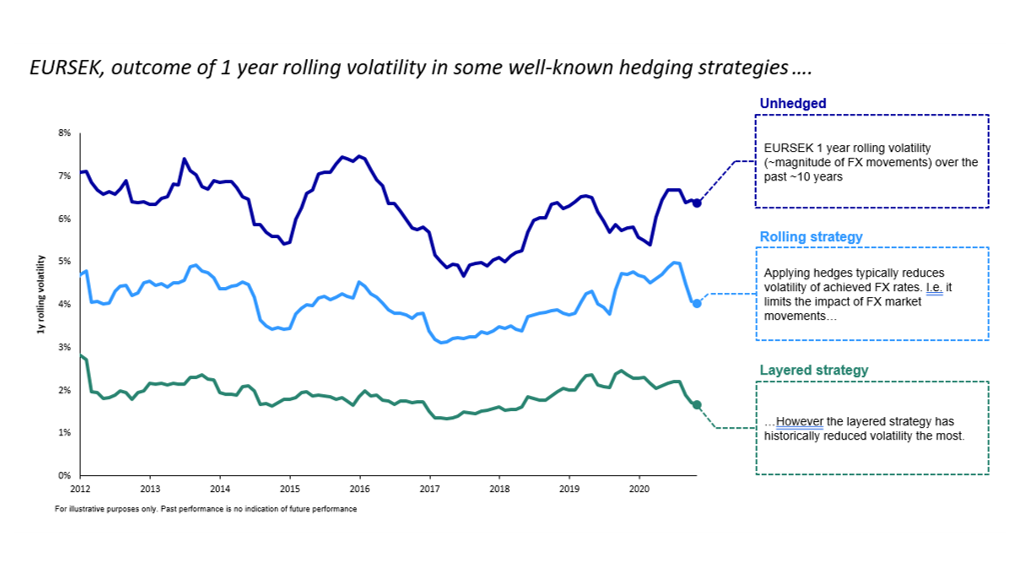

Below we will discuss some situations where it may be. Hedging also called caution or cautious language or tentative language or vague language is a way of softening the language by making the claims or conclusions less absoluteIt is especially common in the sciences for example when giving a hypothesis or presenting results though it is also used in other disciplines to avoid presenting conclusions or ideas as facts and to distance. A better way to understand the uses applications of swaps is to look at the market risks each industry is likely to incur in their business.

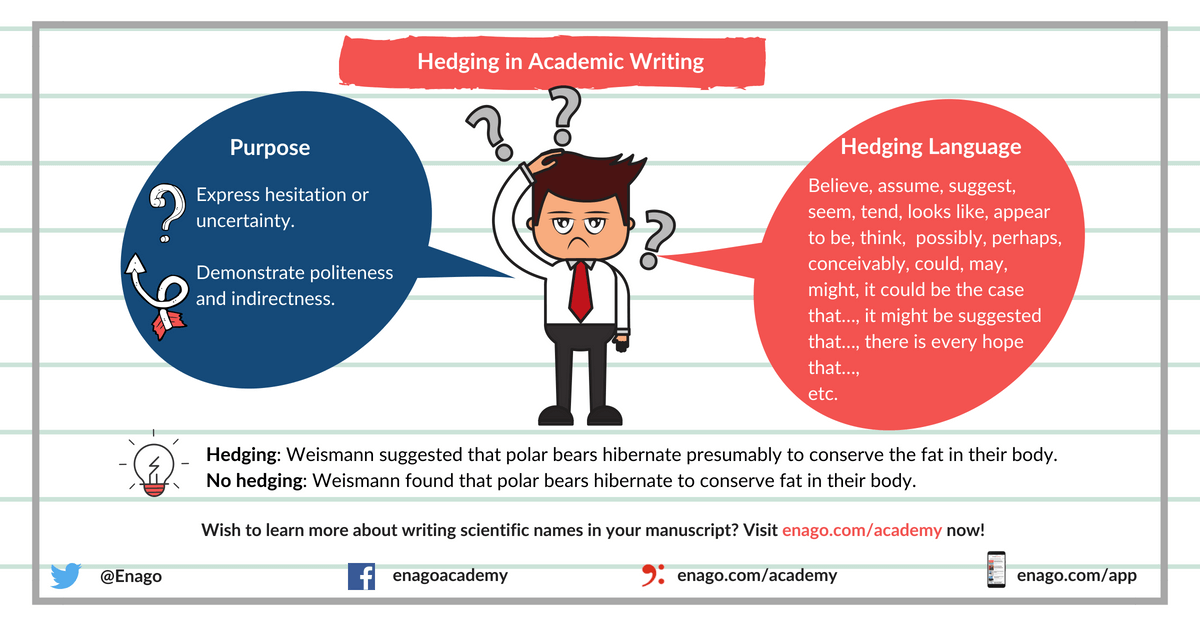

Hedging is the use of linguistic devices to express hesitation or uncertainty. Electricity price hedging is getting popular among many energy companies due to the onslaught of deregulation in the electricity sector. In addition the majority of public listed Kenyan firms use natural hedging because the derivatives market in Kenta is not yet well developed.

An entity that has a liability in a foreign currency and wants to protect itself against the change in the foreign exchange rate a company entering into an interest rate swap so that the floating rate of a loan becomes a fixed rate Types of. Why can hedging be valuable. Answer 1 of 2.

2 In order to take the smile into account traders often use the BlackScholes model with the implied volatility of the option as volatility parameter. Stock investors often use this strategy of hedging their investments. Task One Task Two Task Three Rate this Exercise Task One.

Gay and Na m 1998 find that firms with enhanced investment. This is commonly known as hedging. If the price of a stock theyve previously purchased declines significantly they buy more shares at the lower price.

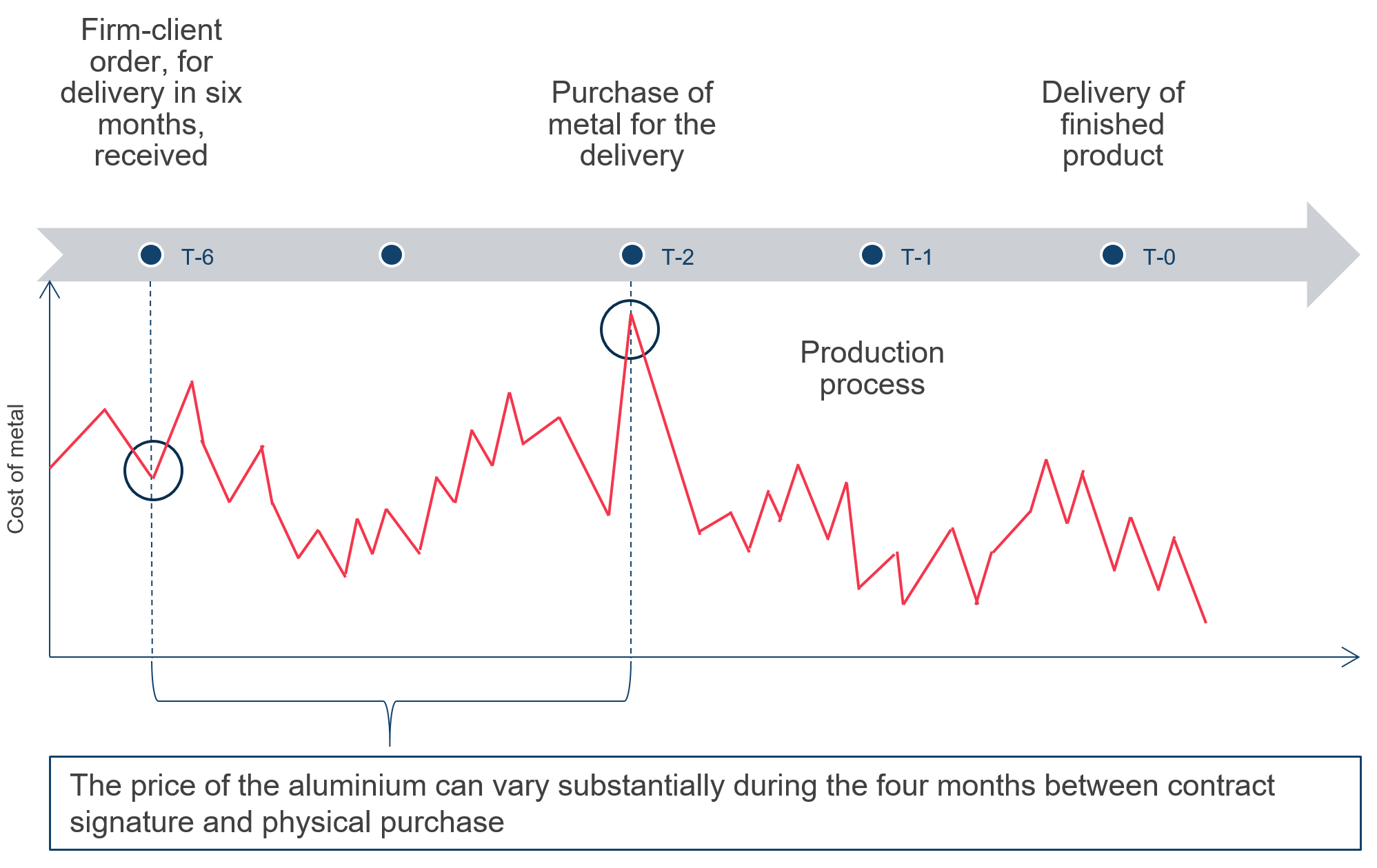

Price hedging most often is used to manage power supply costs or to engage in arbitrage opportunities and is becoming a major ingredient in companies risk management strategies. A common hedging technique used in the financial industry is the longshort equity technique. All great questions and they would best be answered by outlining a few examples from different industries and companies.

Six emerging market currencies were focused upon. There are four primary reasons that an academic would choose to use hedging language. Swaps are used by all industries to hedge risk.

But for those businesses which may include companies in the travel chemical food and importexport industries there is another way. Examples in which hedging is used include. Hedging is an attractive option when you expect exposure to an above-average risk.

Options offer the greatest diversity of risk-reward profiles for companies looking to offset their most complex risks. If you wish to know more about hedging before you attempt the activities here go to Part One or Part Two and complete the activities there first. Hedging in such circumstances is often tricky and warrants the use of flexible instruments.

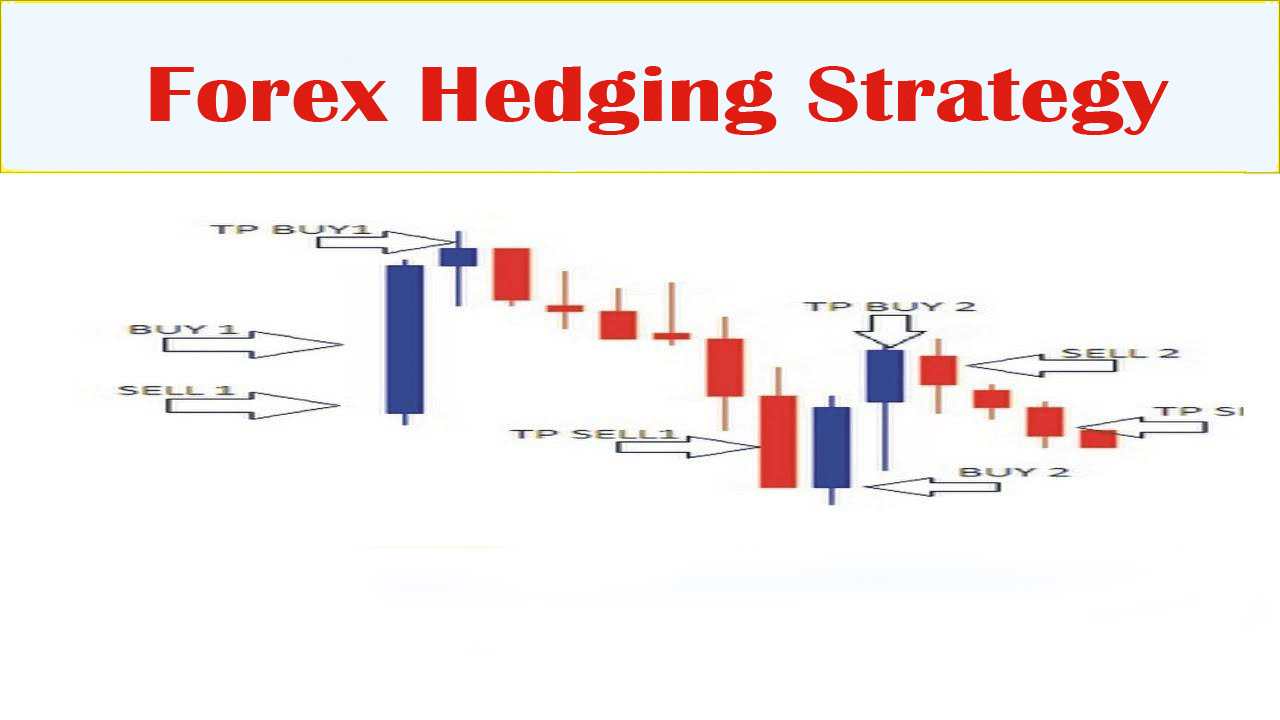

Time modifiers such as often or frequent should be used along with the most in a superlative context. But if employed correctly it can be very effective. When hedging traders should be aware that it is a protective strategy used to offset losses not a strategy used to gain profit.

What does hedging look like now. When used properly derivatives can. Some examples are companies that pay in foregn currencies rely on floating interest rates.

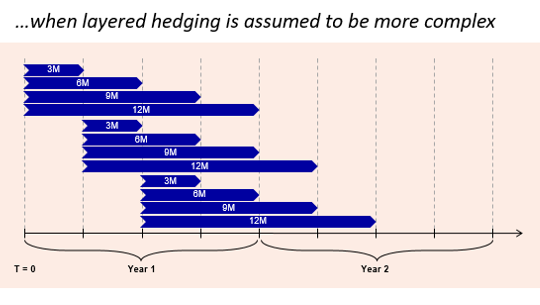

Farmers and dealers still hedge grain on a daily basis. But why would it be necessary to do this in an academic context. By applying an automated micro-hedging solution combined with hedge accounting companies will reduce these gains and losses and minimize temporary volatility in the Profit and Loss Statement PL.

What kinds of companies and industries use hedging techniques. In this article you can find everything you need to know about this topic. 2 What lottery numbers come up most often Notice the is missing in the latter sentence.

DELTA HEDGING VEGA RISK. As far as risk management goes hedging is an extremely useful tool for traders to protect their profits and prevent substantial losses. Remember that one of the primary purposes of.

On equity index or currency. To reduce the possibility of being proven wrong by other researchers peers or academics such as your tutor.

Pdf Hedging Strategy Influencing Derivative Investment On Investors

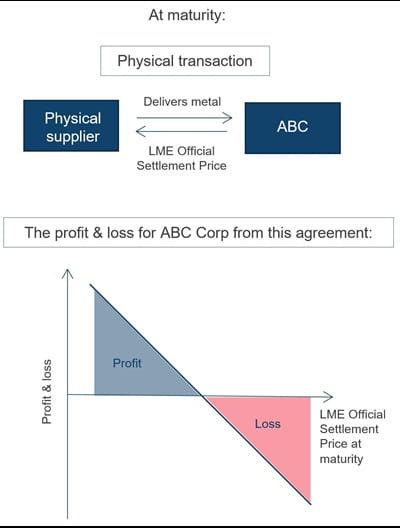

Physical And Financial Hedging Beginners Guide London Metal Exchange

Hedging Solutions Global Risk Management

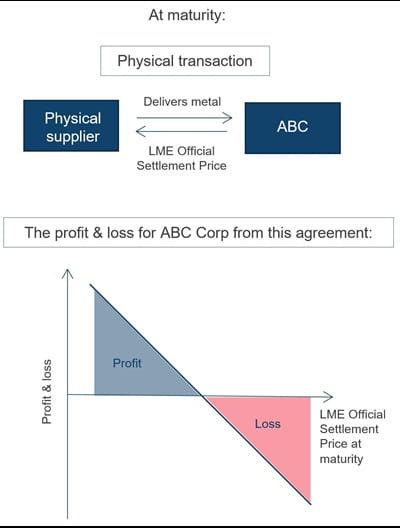

An Effective Hedging Strategy Helped This Company Dodge Fx Losses During Covid 19 Nordea

Hedging Cautious Language Lesson And Worksheet

An Effective Hedging Strategy Helped This Company Dodge Fx Losses During Covid 19 Nordea

What Is Hedging In Academic Writing Enago Academy

Physical And Financial Hedging Beginners Guide London Metal Exchange

Physical And Financial Hedging Beginners Guide London Metal Exchange

.png)

What Is The Best Financial Instrument For Hedging Ig Uk

An Effective Hedging Strategy Helped This Company Dodge Fx Losses During Covid 19 Nordea

What Is Hedging In Academic Writing Enago Academy

Forex Hedging Strategy Two Currency Pairs Is The Best Strategy

What Is Hedging Risk Management Stock Market Financial Decisions

Physical And Financial Hedging Beginners Guide London Metal Exchange

Currency Risk Hedging In Real Estate Benchmarks Msci

Pdf Hedging Strategy Influencing Derivative Investment On Investors

Comments

Post a Comment