If You Use Fifo Which Disclosures Are Required

Manually instantiating the FIFO Intel FPGA IP core. Under FIFO companies attribute the cost of their oldest goods to their newest sales.

Details Of The Fifo Lifo Inventory Valuation Methods Method Financial Management Sample Resume

Under first-in first-out FIFO method the costs are chronologically charged to cost of goods sold COGS ie the first costs incurred are first costs charged to cost of goods sold COGS.

. Which of the following disclosures is required for a change from LIFO to FIFO. The disclosures objective is to provide financial statement users with information useful in assessing how different measurement methods may. FIFO stands for first in first out and assumes the first items entered into your inventory are the first ones you sell.

If you do business globally youll need to stick with FIFO or another approved inventory valuation method since the international accounting standards body. Price calculations checked 1285 1284 Average entry price 12845 Scale out 1 contract 1284 Can you please perform a similar test on your end while connected to the Simulated Data Feed and check if you experience the same outcome. If you want to read about its use in.

Finish drafts of each of your project segments and have someone you trust read it and offer feedback. FIFO stands for First-In First-Out. Project-FiFo UG may disclose your Personal Data in the good faith belief that such action is necessary to.

If you sold 25 of those shares you would have a taxable gain of 200 per share since you purchased the. The cumulative effect on prior years net of tax in the current retained earnings statement. To calculate ending Inventory cost using the FIFO Perpetual method can take a lot of work and may require us to create a running tabular balance to keep track.

FIFO stock trades refer to selling your longest held shares of a stock first while LIFO trades sell your most recently acquired shares. For tax purposes FIFO. If you use the FIFO method it doesnt mean that you really have to.

LIFO has been the subject of some budget controversy in the United States. The justification for the change Restated financial statements for all prior years presented All of these are required. If you want the output of the command to be written to your pipe represented by the w_fifo2 descriptor in your code then you should duplicate it into STDOUT_FILENO just like you do now but not redirect output in the command you run.

You can also post your draft in the forums for feedback if you like. This includes whether it is cost or the lower of cost or net realizable value and also the cost flow assumption such as 1 first-in first-out or FIFO 2 last-in first-out or LIFO 3 weighted average etc. A court or a government agency.

FIFO is a method of valuing inventory and cost of goods sold COGS. The Fine Electronics company uses perpetual inventory system to account for acquisition and sale of inventory and first-in first-out FIFO method to compute cost of goods sold and for. The FIFO parameter editor provides options that you can easily use to configure the FIFO Intel FPGA IP coreYou can access the FIFO Intel FPGA IP core parameter editor in Basic Functions On Chip Memory FIFO of the IP catalog.

The opposite is true under LIFO. This article explains the use of first-in first-out FIFO method in a periodic inventory system. If you have any questions contact your advisor to discuss.

The FIFO method assumes that the oldest products in a companys inventory have been sold first. With Use FIFO for position avg. Managers must have a way to account for the different prices assigned to inventory at the end of each accounting period.

In my practice the main concern is area power. Choosing either one will lead to other differences like test methodologies. If you wanted to sell shares of Flooble you would be forced to use FIFO accounting.

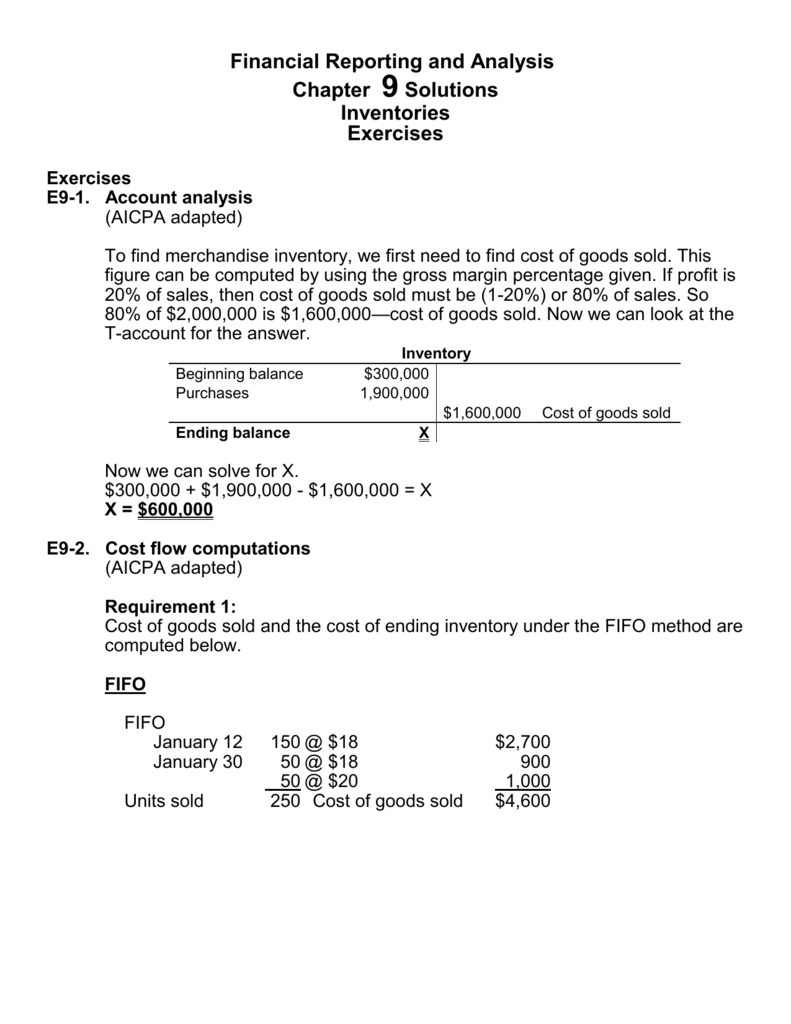

Accounting questions and answers. In this example it would be the shares you purchased for 100 each. FIFO and LIFO are the two most common inventory valuation methods.

There is no formal graded assignment this week. First In First Out commonly known as FIFO is an asset-management and valuation method in which assets produced or acquired first are sold used or disposed of first. Depending on our Inventory system we can use either FIFO Periodic or FIFO Perpetual.

In addition a manufacturer and others with inventory should disclose the method for valuing the inventory. Will redirect standard output to a file named w_fifo2. Entities would be required to disclose the measurement basis usedLIFO first-in first-out FIFO LIFO RIM or weighted averageand the amount of inventory measured within each basis.

March 28 2019. RAM hard macro tends to have smaller size when the memory capacity grows. FIFO and LIFO represent accounting methods that determine the value of a companys unsold inventory cost of goods sold and other transactions.

The costs paid for those oldest products are the ones used in the calculation. You should review the Booklet and keep a copy for your records. It is a method used for cost flow assumption purposes in the cost of goods sold calculation.

Theres still work to do after choosing RAM we need to try different combination of processmuxshape to find the one with minimum area and power. Under certain circumstances Project-FiFo UG may be required to disclose your Personal Data if required to do so by law or in response to valid requests by public authorities eg. Use this method only if you are an expert user.

With the FIFO method the assumption is made that the first products purchased put into inventory are the first to be sold taken out of inventory. Use the forums to see if your peers will help you out. The cost of the newest goods is attributed to the newest sales.

The agreements and disclosures section of the website you use to access your JPMS accounts or is available from your PCA or FA. LIFO last-in-first-out and FIFO first-in-first-out are the two most common inventory cost methods that companies use to account for the costs of purchased inventory on the balance sheet. If LIFO is used the company must disclose what the dollar amount of inventory.

If you want to understand its use in a periodic inventory system read first-in first-out FIFO method in periodic inventory system article. You must tell your broker for any sales treatment besides FIFO. By continuing to maintain your JPMS accounts you are agreeing to the amended terms.

IAS 2 Inventories contains the requirements on how to account for most types of inventory. By comparison companies reporting under International Financial Reporting Standards IFRS are required to use FIFO only. In other words you would be forced to sell some of the shares from your first tax lot.

Note that this is only an assumption. FIFO is an acronym for First In First Out. Use this week to bring your project together.

First In First Out FIFO means the first inventory in will also be the first inventory to be sold. The standard requires inventories to be measured at the lower of cost and net realisable value NRV and outlines acceptable methods of determining cost including specific identification in some cases first-in first-out FIFO and weighted average cost.

Fifo Queue Algorithm Used To Update The Distribution Of Tissue Patches Download Scientific Diagram

Comprehensive Example Fifo Perpetual Open Textbooks For Hong Kong

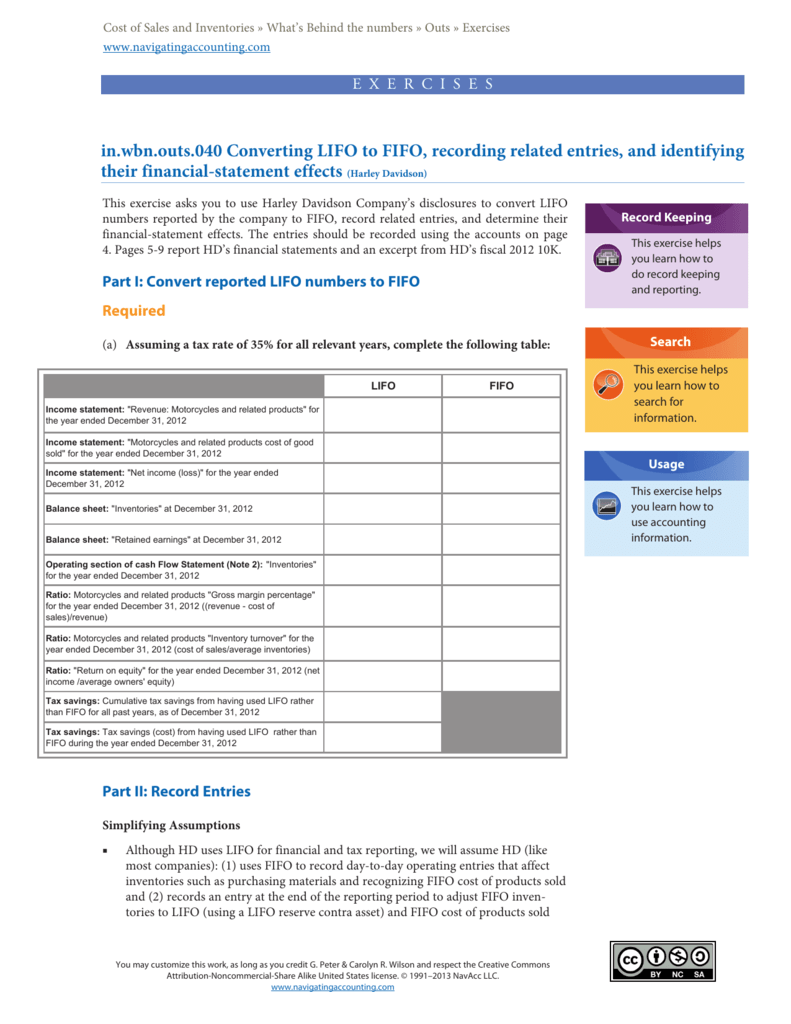

In Wbn Outs 040 Converting Lifo To Fifo Recording Related Entries

Fifo Inventory Valuation In Excel Using Data Tables How To Pakaccountants Com Excel Tutorials Excel Microsoft Excel Tutorial

Hypothetical Comparison Of Fifo Versus Lifo Calculation Of Income Tax Download Table

2022 Cfa Level I Exam Cfa Study Preparation

Pre Dispatch Timer Driver App Lyft Request

Inventory Valuation Lifo Fifo Lower Of Cost Of Market Lifo Dollar Perfectgrader

Spot The Difference Fifo Vs Lifo Fifo Stands For First In First Out While Lifo Stands For Last In First Accounting Principles Inventory Accounting Accounting

Fifo Queue Algorithm Used To Update The Distribution Of Tissue Patches Download Scientific Diagram

Schematic Diagrams Of The Proposed Mbf Method Based On A Shared Fifo Download Scientific Diagram

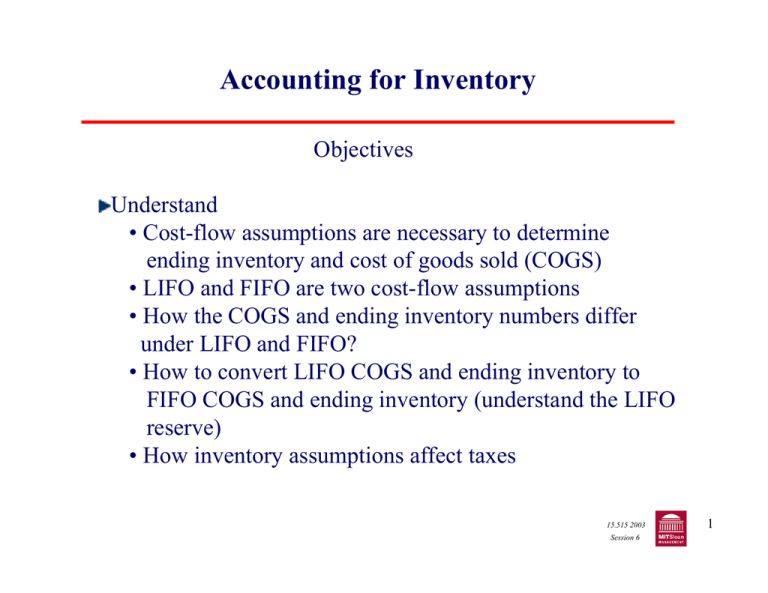

Lec6 Lecture Notes 6 Objectives Understand Cost Flow Assumptions Are Necessary To Determine Studocu

Fifo Calculator Fifo Inventory Accounting Principles Calculator Microsoft Excel

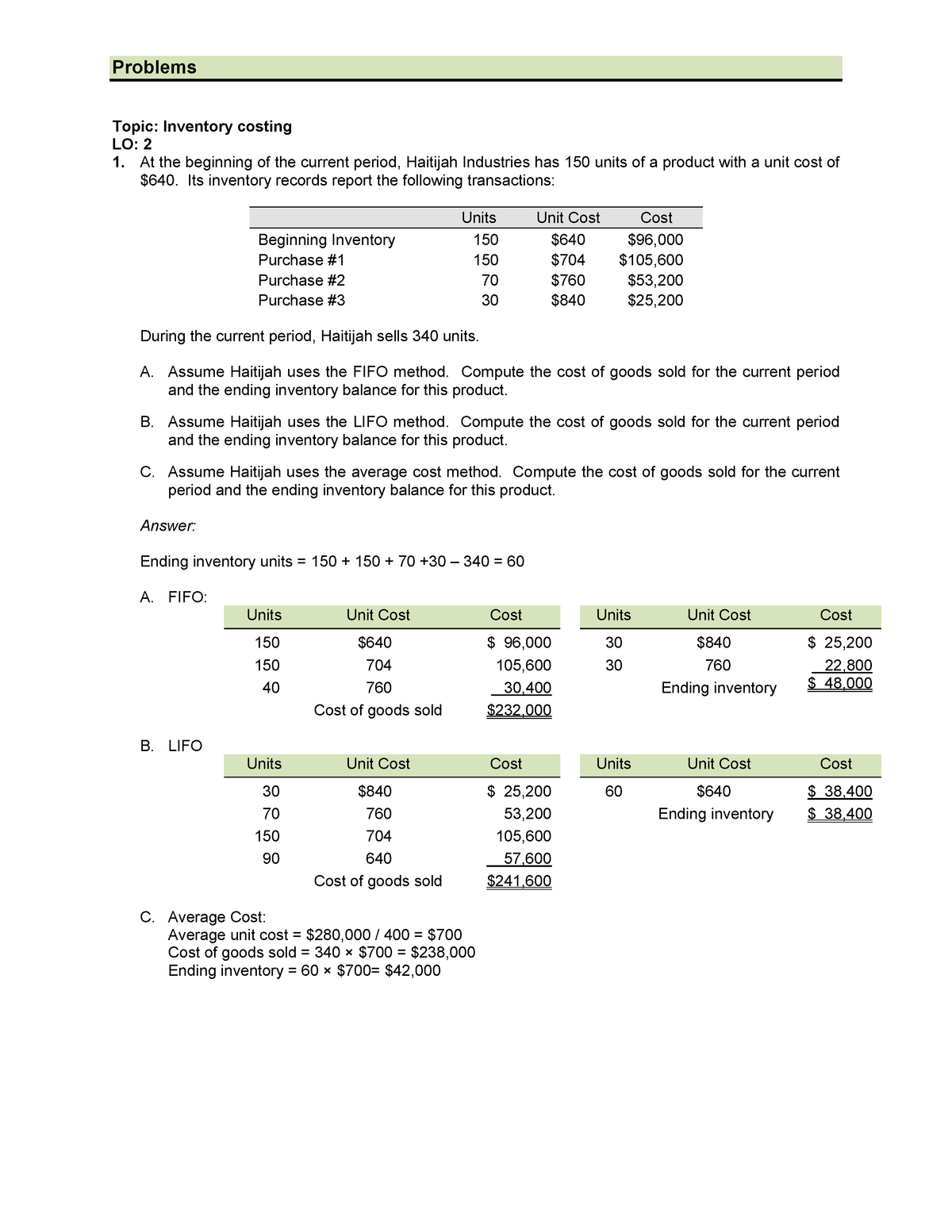

Mgmt E 1000 Study Guide For Final Exam Fall 2017 Problems Topic Inventory Costing Lo 2 1 At Studocu

Comments

Post a Comment